A recent blockchain analysis report revealed a steady rise in sales and crypto-linked transactions on darknet marketplaces in 2023. The data indicates that darknet marketplaces received revenue of approximately $1.7 billion in 2023.

Key Facts

- Darknet marketplaces saw a revenue increase to approximately $1.7 billion in 2023.

- The 2024 Crypto Crime Report by Chainalysis highlighted this revenue increase. This comes after a year of withdrawing from Darknet Markets after Hydra’s closure.

- The closure of the Hydra Market in 2022, which accounted for about 80% of all darknet crypto transactions since 2015, led to a decrease in crypto-linked transactions.

- Post-Hydra, several smaller niche-oriented darknet marketplaces thrived, increasing overall market revenue.

- Mega Darknet Market and Kraken Market are among the leading marketplaces post-Hydra.

- The 2024 report noted a trend of darknet marketplaces specializing in specific niches.

- Revenue from niche marketplaces has not yet surpassed peak levels seen during the operation of Silk Road, AlphaBay, Wall Street, and Hydra.

- In 2023, OFAC imposed 18 sanctions on individuals or entities involved in cryptocurrency, focusing on entities and jurisdictions under sanctions, which amounted to $14.9 billion or 61.5% of all illicit transaction volume.

- The sanctioned individuals include the North Korean hacking group Kimsuky, crypto mixer Sinbad.io, Russian national Ekaterina Zhdanova, and Gaza-based MSB Buy Cash.

- Revenue from crypto-based scams declined from $5.9 billion in 2022 to $4.6 billion in 2023.

- Romance scams, also known as pig butchering scams, saw a significant increase in revenue, with an 85% growth rate since 2020.

Chainalysis’ 2024 Crypto Crime Report highlighted $1.7 billion in revenue in darknet markets and a rebound from the previous year. The blockchain analysis expert’s data is based on cryptocurrency-linked transactions from darknet marketplaces over the past 12 months.

Meanwhile, crypto-linked sanctions by the US Office of Foreign Assets Control (OFAC) doubled in the past year.

What We Know About The Figures

Darknet marketplaces experienced a resurgence in revenue in 2023, generating approximately $1.7 billion in revenue. The figures released in the Chainanalysis 2024 Crypto Crime Report marked a significant recovery from the revenue generated in 2022.

The decrease in crypto-linked transactions and sales on the darknet was due to the shutdown of Hydra Market, the then world’s largest and longest-running darknet market, by German authorities in 2022. Hydra Market accounted for approximately 80% of all darknet crypto-related transactions, since 2015.

Since Hydra’s closure, no single marketplace has emerged as a successor. Instead, several smaller niche-oriented darknet marketplaces have thrived, collectively increasing the market’s revenue growth. Mega Darknet Market led the group, with over $500 billion in crypto inflows, followed by Kraken Market.

Chainanalysis’s 2024 report indicated that darknet administrators opted to specialize in “specific niches and have individually organized themselves into unique criminal functions.”

The resurgence of smaller niche marketplaces is not unprecedented and reflects a pattern often seen after the shutdown of larger darknet markets. The revenue currently generated from these niche marketplaces is yet to surpass the peak levels recorded when Silk Road, AlphaBay, Wall Street, and Hydra were in operation.

Eric Jardine, cybercrime research lead at Chainalysis: “We expect law enforcement agencies to continue to investigate and dismantle darknet markets, especially given that many offer fentanyl products for sale.”

The report also highlighted a doubling in cryptocurrency-related sanctions imposed by the United States Office of Foreign Assets Control (OFAC) in 2023, with a total of 18 sanctions on individuals or entities.

Chainanalysis’s blockchain experts reported that Illicit crypto transactions amounting to $14.9 billion were associated with entities and jurisdictions under these sanctions. The amount comprised 61.5% of all the illicit transaction volume.

Based on the report, crypto-linked sanctions imposed by OFAC shifted away from major darknet markets such as Garantex and Hydra, as well as mixers like Tornado Cash, and toward groups and individual actors.

The list of individuals linked to crypto who have been sanctioned includes the North Korean hacking group Kimsuky, crypto mixer Sinbad.io, Russian national Ekaterina Zhdanova, and MSB Buy Cash based in Gaza.

The report also presented some positive figures for law enforcement authorities as there was a decline in revenue from crypto-based scams. Crypto-based scams decreased from $5.9 billion in 2022 to $4.6 billion in revenue in 2023.

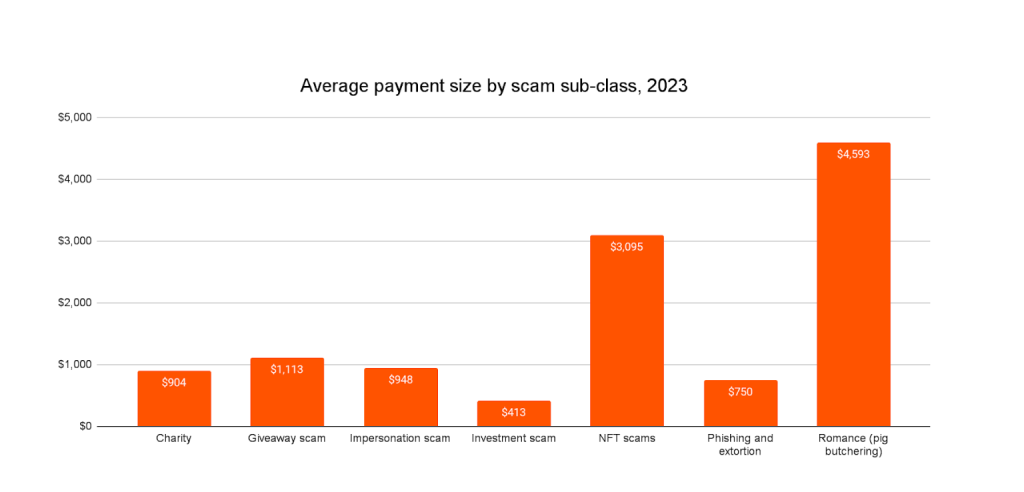

Despite law authorities’ efforts to curb fraudulent activities, there was a surge in new forms of scams in 2023, including romance scams, also known as pig butchering scams. These scams experienced a significant increase in revenue, more than doubling year-over-year with an 85% growth rate since 2020, according to data.

Eric Jardine on the rise of romance scams: “These scams take weeks or months as scammers look to gain the trust of their victims. Users who are not aware of the signs to spot scams can easily fall prey.”

A pig butchering scam is a sophisticated financial fraud scheme where scammers build a relationship and trust with their victims over time through social media or messaging apps. Once trust is established, they manipulate the victims into making financial investments or transactions, ultimately leading to significant financial loss for the victim.

The Chainalysis report highlights that out of all types of scams, romance scams have the worst impact on victims due to the average payment size. Furthermore, there was a rise in the prevalence of approval phishing scams in 2023.