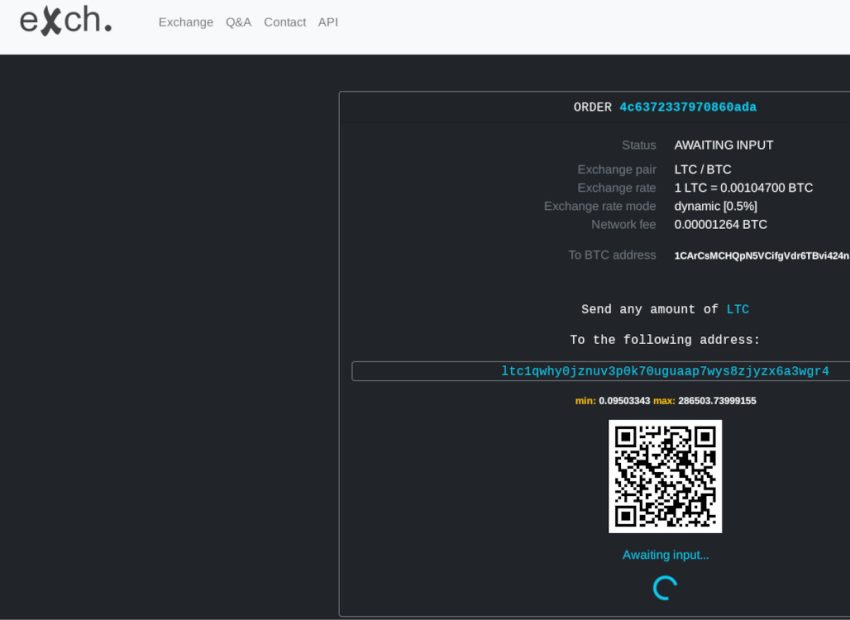

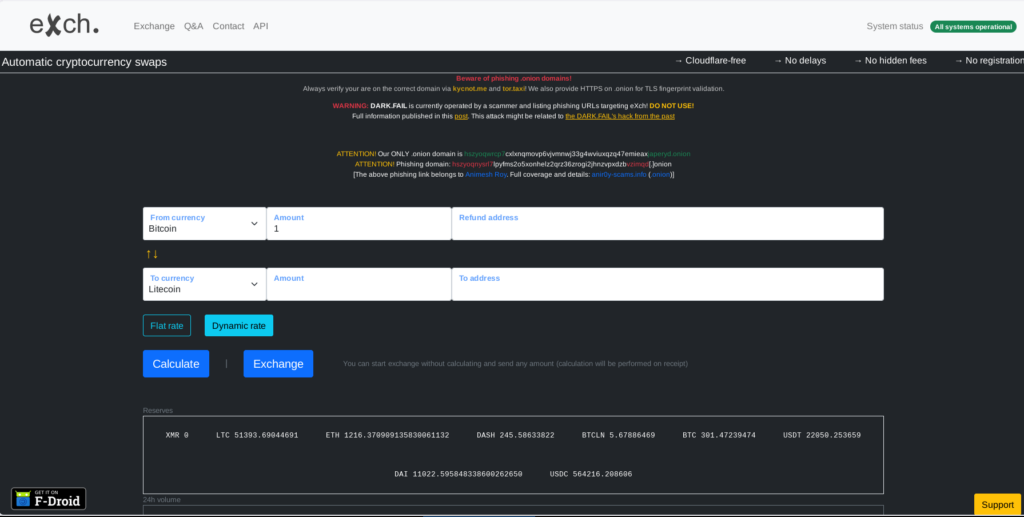

Go to EXCH Crypto Exchange from here.

Over the past decade, cryptocurrency markets have rapidly emerged from niche online communities of technological enthusiasts into global trading platforms servicing millions of users. The growing influence of decentralized finance and digital currencies has brought such issues as privacy, security, and financial freedom into the spotlight. One of the leading platforms catering to users with said concerns in mind is the anonymous cryptocurrency exchange EXCH. In this article, we go over unique features of EXCH, some pros and cons, and see where this cryptocurrency fits into the landscape.

What is EXCH?

EXCH is an anonymous cryptocurrency exchange, positioning itself as a platform for users who appreciate privacy, anonymity, and security. The main difference between EXCH and most other traditional exchanges that implement long procedures of KYC/AML is that EXCH actually allows its users to trade without disclosure of their identity. This is a major attractant for those in need of keeping their financial and personal information confidential in the digital world.

This exchange supports several cryptocurrencies, including most of the key ones: Bitcoin, Ethereum, and such privacy coins as Monero and Zcash. The cryptographic techniques, peer-to-peer trading mechanisms, and completely decentralized architecture of EXCH support each other in a way to guarantee users anonymity and data security.

Key Features of EXCH

EXCH’s appeal lies in its comprehensive features that cater specifically to privacy-focused users. Here are some of the key elements that set it apart from traditional cryptocurrency exchanges:

1. No KYC/AML Requirements

Perhaps the most significant feature of EXCH is its complete lack of KYC or AML procedures. Users do not need to provide identification documents, submit personal information, or disclose their location. This approach prioritizes user anonymity, making EXCH an attractive option for those who wish to remain private while trading cryptocurrencies.

2. Decentralized Exchange (DEX) Model

EXCH operates as a decentralized exchange (DEX), which means that trades occur directly between users through smart contracts rather than relying on a central authority or third-party intermediary. This model increases security by minimizing the risk of hacking or data breaches associated with centralized exchanges.

3. Privacy Coins Support

In addition to mainstream cryptocurrencies, EXCH supports several privacy-focused coins, such as Monero (XMR), Zcash (ZEC), and Dash (DASH). These coins are designed to provide an extra layer of privacy, using techniques such as ring signatures, zero-knowledge proofs, and private transaction masking to obfuscate user data.

4. Peer-to-Peer Trading

EXCH facilitates peer-to-peer trading, allowing users to interact directly with one another when buying or selling assets. This further enhances privacy, as there is no centralized entity overseeing transactions. The platform uses a built-in escrow system to secure funds during trades, ensuring that both parties meet their obligations before the transaction is finalized.

5. Enhanced Security Measures

Security is a critical consideration for any cryptocurrency exchange. EXCH employs a range of advanced security measures, including two-factor authentication (2FA), encrypted communication, and multi-signature wallets. Additionally, because it operates as a decentralized exchange, users maintain control over their private keys, reducing the risk of fund theft.

6. Low Fees

In comparison to many centralized exchanges, EXCH offers competitive trading fees. Its peer-to-peer model and lack of regulatory overhead allow the platform to maintain lower transaction costs, benefiting users who engage in frequent trading.

7. Cross-Chain Trading

EXCH also supports cross-chain trading, allowing users to swap assets between different blockchain networks. This is an increasingly important feature as the crypto ecosystem becomes more diverse and interconnected.

8. Accessibility Worldwide

Because EXCH doesn’t adhere to stringent regulatory requirements, it is available to users in regions where centralized exchanges might be restricted. This global accessibility makes it an appealing option for users in countries with limited access to crypto trading platforms.

Pros and Cons of EXCH

| Pros | Cons |

|---|---|

| Full Anonymity: No KYC or AML requirements. | Regulatory Uncertainty: May face legal issues in some jurisdictions. |

| Decentralized Exchange: Users maintain control over their private keys. | Limited Customer Support: Decentralized structure limits support services. |

| Supports Privacy Coins: Monero, Zcash, and others. | Security Risks in Peer-to-Peer Trades: Users must carefully vet trade partners. |

| Competitive Fees: Lower transaction fees compared to centralized exchanges. | No Fiat Support: Only crypto-to-crypto trades; no fiat currency options. |

| Global Accessibility: Accessible to users worldwide, even in restricted regions. | Limited Liquidity: P2P model may lead to lower liquidity compared to centralized exchanges. |

| Cross-Chain Trading: Swap between different blockchain networks. | Learning Curve: May not be user-friendly for beginners. |

| Enhanced Security: Multi-signature wallets, 2FA, and encryption. | No Insurance for Losses: Unlike some centralized exchanges, no insurance for fund losses. |

Why Anonymity is Important in Crypto Trading

The rise of blockchain and digital assets was driven by ideals of decentralization, privacy, and freedom from centralized control. However, as cryptocurrency adoption has grown, so too have regulatory requirements. Many governments have implemented stringent KYC and AML regulations, requiring exchanges to gather detailed information about their users.

While these measures are intended to prevent illegal activities such as money laundering and terrorist financing, they also raise concerns about user privacy, data security, and government surveillance. For many cryptocurrency users, financial transactions should remain private, free from scrutiny by centralized authorities.

EXCH fills this need by offering an anonymous trading platform that adheres to the original principles of blockchain technology. By prioritizing privacy and decentralization, EXCH provides users with the ability to engage in cryptocurrency trading without compromising their personal information.

Potential Drawbacks and Risks

While EXCH’s anonymity and privacy-focused features are appealing, they also come with certain risks and limitations:

1. Regulatory Issues

Operating without KYC or AML procedures places EXCH in a precarious position in relation to government regulations. Many countries have implemented strict rules for cryptocurrency exchanges, and platforms that fail to comply may face fines, legal challenges, or outright bans. Users in certain regions should be aware of potential legal risks when using anonymous exchanges.

2. Security Concerns in P2P Trades

While the decentralized nature of EXCH enhances security, the peer-to-peer model introduces potential risks. Users must trust the individuals they are trading with, and although the platform offers an escrow system to reduce fraud, there is still a level of vulnerability in direct trades.

3. No Fiat Support

EXCH only supports crypto-to-crypto trading, which may be a limitation for users who want to exchange fiat currencies like USD or EUR for cryptocurrencies. Users looking to buy crypto with fiat must first use a separate service to convert their funds.

4. Lower Liquidity

The decentralized, peer-to-peer model of EXCH can lead to lower liquidity compared to centralized exchanges. This may result in higher spreads and longer wait times to execute trades, especially for less popular cryptocurrency pairs.

Final Words

EXCH offers a compelling solution for privacy-focused cryptocurrency traders. Its anonymity, lack of KYC requirements, decentralized model, and support for privacy coins make it an attractive option for users seeking to maintain control over their personal and financial data. However, it also presents certain risks, particularly regarding regulatory compliance and the potential security challenges inherent in peer-to-peer trading.

For users who value anonymity and are comfortable navigating decentralized platforms, EXCH could be an excellent choice. However, those who require fiat support or more robust customer service may need to explore other options. As the regulatory landscape continues to evolve, it will be important for users to stay informed about the legal implications of using anonymous cryptocurrency exchanges like EXCH.